The Day the "Dip and Rip" Became Just "The Rip"

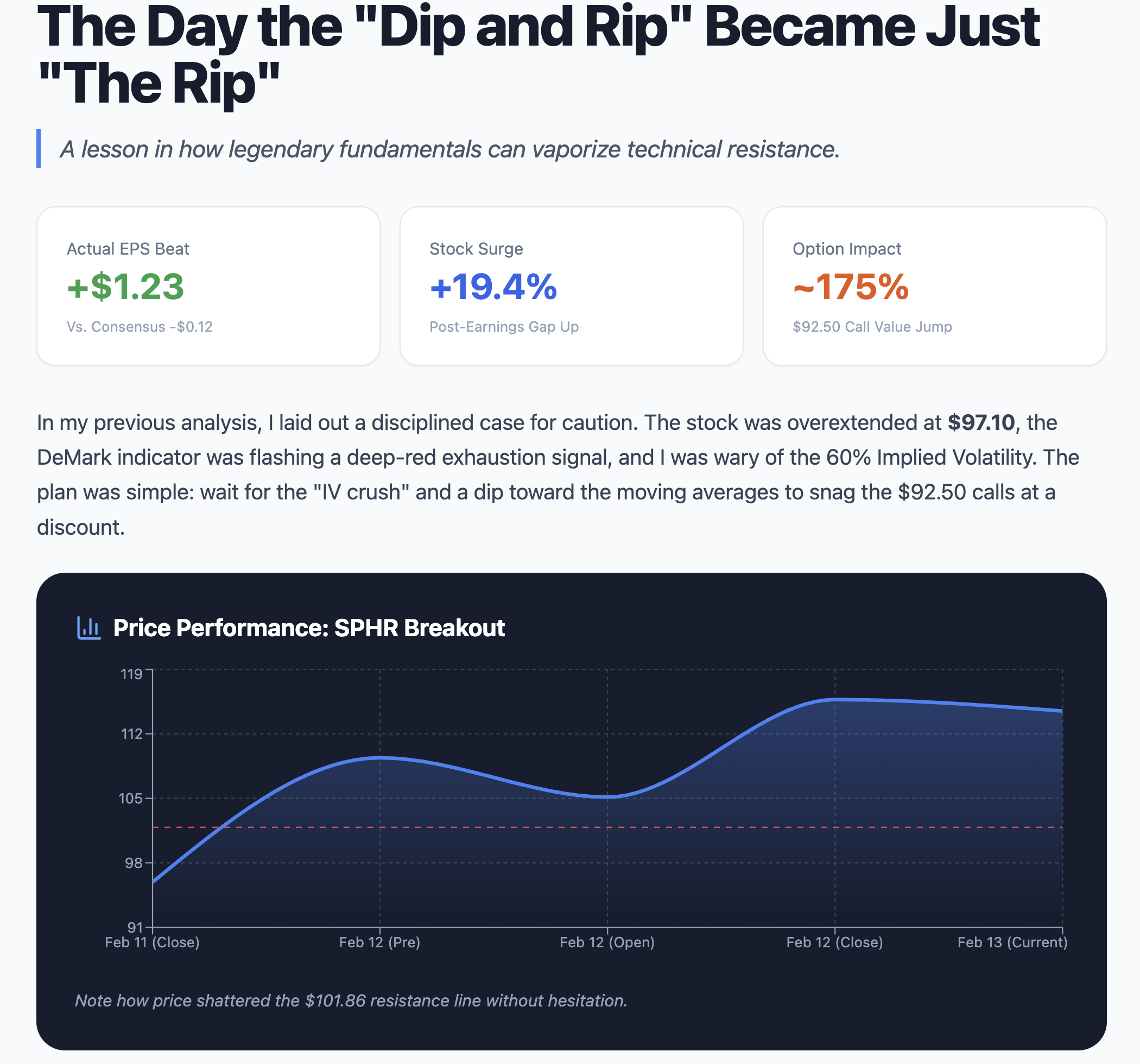

In my last update, I was looking for a technical pullback on Sphere Entertainment (SPHR). The stock was at $97.10, the DeMark indicator was hitting a peak of 0.9077, and Implied Volatility (IV) was a steep 60%. My plan was disciplined: sidestep the "IV crush" and the $101 resistance, wait for a post-earnings dip toward the moving averages, and then snag the $92.50 calls for the recovery.

Well, the results are in. Not only did the dip never happen, but we just witnessed one of the most explosive fundamental breakout rips of 2026! And we missed out on the gains, but a silver lining from our research nonetheless.

The Earnings Shock: February 12th

On Thursday morning, SPHR didn't just "turn a corner"—it blasted through the wall.

The Massive Beat: Analysts were looking for a modest swing to $0.12 EPS. Instead, SPHR reported a staggering $1.23 adjusted EPS—a 1,169% surprise.

Revenue Dominance: Revenue hit $394.3 million, fueled by a 62% jump in Sphere venue revenue. The "Sphere Experience" (including The Wizard of Oz) generated $274.2 million alone.

Market Reaction: The stock ignored every technical resistance level. It gapped through $101 in pre-market and closed the day up 22% at $115.72.

Today’s Market Check: Friday, February 13th

Checking the screens today, the stock is holding its ground, showing that yesterday wasn't just a "one-day wonder."

Current Price: SPHR is trading around $115.70, proving that the new valuation has staying power.

New Support: Yesterday’s ceiling at $101.86 has now effectively become the new floor.

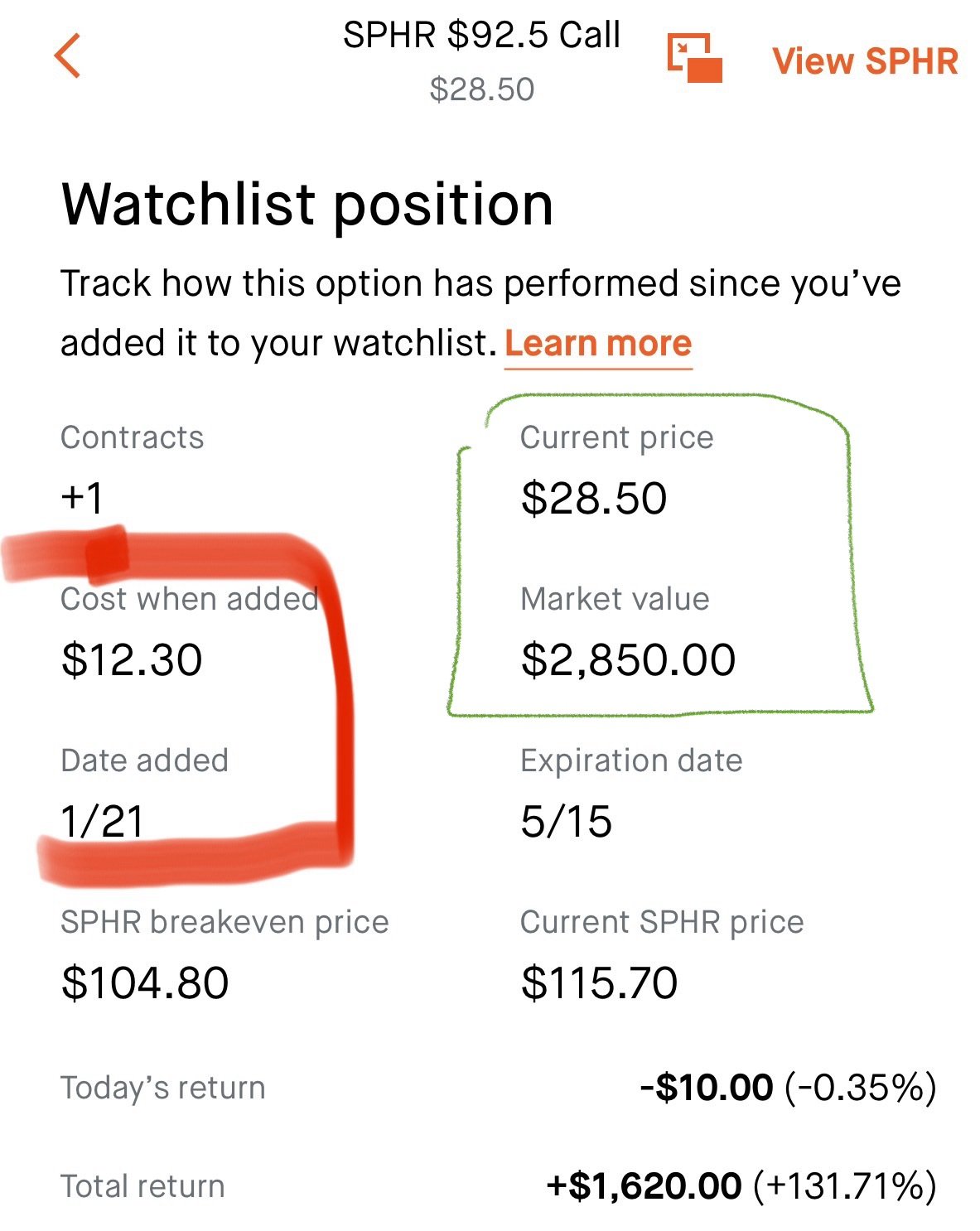

Option Pain: For those of us who waited, the $92.50 calls are now deep "In-The-Money." That "inflated premium" I was worried about has been replaced by massive intrinsic value.

The "No-Trade" Post-Mortem

It’s easy to look at a 20%+ move and feel the sting of a missed opportunity. If I had bought those $92.50 calls, the portfolio would be celebrating a 2x or 3x return today.

However, I have to stand by the discipline of the process:

Risk vs. Reward: Buying a stock at an all-time high with extreme overbought indicators is historically a losing game.

Capital Preservation: As the saying goes, "I'd rather be out of a trade wishing I was in, than in a trade wishing I was out." There was no real money lost, only potential gains missed.

The Process Worked: The logic for a "mean reversion" was sound based on technicals. What changed wasn't the chart—it was the business model. SPHR shifted from a "story" to a profitable powerhouse in 90 minutes.

My Final Verdict

The "Dip and Rip" play is dead. We are now in a "Buy the Consolidation" phase. SPHR has proven it can generate massive cash flow ($89.4 million in adjusted operating income for the Sphere segment).

I am moving SPHR to a "Wait for Support" watch. If we see a retest of the $105–$110 range with declining volume, that will be our second chance.

Discipline is what keeps you in the game long enough to catch the next one.